Even if your SMS marketing campaign is following industry best practices to opt in individuals, the statutory damages available in the Telephone Consumer Protection Act (TCPA) can still make your company a target for SMS marketing class action lawsuits. Stated differently, a one-percent chance to win a $20 million TCPA SMS marketing class action lawsuit may be enough incentive to keep a TCPA plaintiffs’ attorney interested, particularly when they’re filing 100 TCPA SMS marketing lawsuits a year.

As a defense attorney who has successfully handled dozens of TCPA lawsuits over the last several years, there’s one thing that your business should be doing that can easily remove the specter of class action litigation. This is having an enforceable arbitration clause with a class-action waiver contained in your SMS marketing terms and conditions that a consumer must agree to. By limiting an SMS marketing dispute to only one recipient from the outset, this will usually persuade the plaintiffs’ attorney to leave it alone.

In short, if the prospect of obtaining a class-wide TCPA judgment is removed, there’s little incentive for even the most zealous TCPA attorney to pursue what are often frivolous TCPA claims to begin with. And on the other hand, eliminating the costs associated with class-wide discovery should get rid of most of the leverage TCPA plaintiffs’ attorneys have to extract an in terrorem settlement.

What Are Arbitration Agreements?

An arbitration agreement in your SMS marketing terms and conditions essentially provides that any covered dispute between the parties to the agreement will be decided outside of court, by a neutral arbitrator. The benefit of arbitration is that it is usually much cheaper and faster compared to litigation in federal or state court, due in large part to streamlined or limited discovery procedures. This is certainly the case when the arbitration agreement mandates that the arbitration will be conducted only on an individual basis and not in a class, consolidated or representative action.

Are Arbitration Agreements Legal?

As to whether such agreements with consumers are legal, the short answer, is: yes, despite California courts’ best efforts. The California Supreme Court began the battle in 2005 when it’s Discover Bank decision determined that class-arbitration waivers were “unconscionable.” In 2011, the U.S. Supreme Court reaffirmed its long-held favor for arbitration agreements by overturning California’s Discover Bank rule in AT&T Mobility, LLC v. Concepcion.

The Supreme Court reasoned that any state laws or policies that discriminate against arbitration contracts—such as California’s rule finding class action waivers unenforceable—are preempted by the Federal Arbitration Act (“FAA”). Since Concepcion, the U.S. Supreme Court has had to parry additional attempts by California appellate courts to void arbitration agreements containing class action waivers, most recently in its 2015 DIRECTV, Inc. v. Imburgia decision reiterating that class action waivers contained in arbitration agreements are enforceable under the FAA and cannot be struck down on state law grounds.

While the main battle may be over, skirmishes around the margins are ongoing. Last month in McGill v. Citibank NA, the California Supreme Court held that the FAA does require enforcement of a Citibank arbitration provision requiring consumers to waive the right to seek – in any forum – public injunctive relief under California’s Unfair Competition Law and Consumer Legal Remedies Act. This narrow exception, however, does not foreclose the possibility of arbitrating public injunctive relief claims, and should not affect standard agreements to arbitrate disputes on an individualized basis.

Regardless of the limited application of this most recent California decision, it does reinforce the importance of companies including a survival clause in their arbitration agreement so that the entire agreement—including the class action waiver—does not fail because of an unforeseen change in the law.

Are Arbitration Agreements Enforceable?

In SMS marketing, arbitration agreements are usually incorporated into a brand’s SMS marketing terms and conditions. That being said, an arbitration agreement is only helpful if you can enforce the agreement to arbitrate against the particular person who thinks they have a claim against you. When courts are asked to decide this issue, they look at two separate issues. First, you must have a valid agreement that binds the individual to the terms of the agreement, much like other contracts. Second, the scope of the arbitration provision in the agreement needs to be broad enough to cover the individual’s dispute.

A good example of a brand having an arbitration and class waiver provision in their SMS marketing terms and conditions, but it not being enforceable was Dick’s Sporting Goods. In a recent TCPA SMS marketing lawsuit against the retailer, the court refused to compel arbitration, even though they had an arbitration and class waiver provision in their SMS marketing terms and conditions. This was because Dick’s did not require customers to join its SMS marketing program to affirmatively agree to its SMS marketing terms and conditions. Instead, Dick’s simply placed a link to the terms and conditions on its website, which is referred to as a “browsewrap” agreement that is only enforced with reluctance by courts. To be enforceable, Dick’s was required to establish that the customer in question had actual or constructive knowledge of these terms and conditions in order to bind him to an arbitration agreement, which it couldn’t do.

Establishing Customer Consent

So how do you make sure that customers are bound to your SMS marketing terms and conditions before opting into your SMS marketing campaign? It’s actually relatively simple. Customers must be required to affirm their consent to your brand’s SMS marketing terms and conditions – which should contain an arbitration and class action waiver, as detailed above – as a condition of opting into your SMS marketing campaign. Think of agreeing to Apple software updates on your iPhone. It’s that simple.

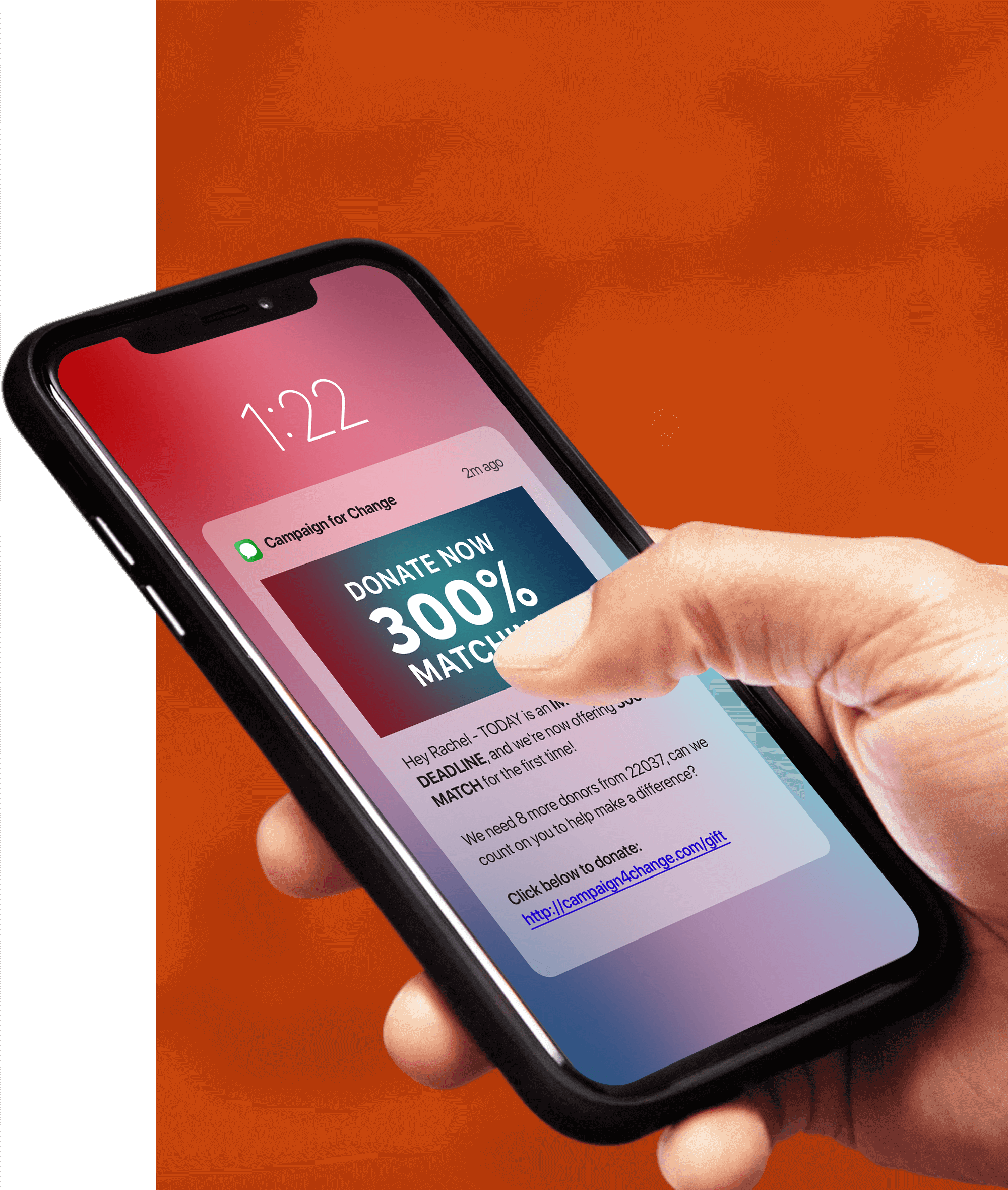

In my experience, there are primarily two ways customers opt into SMS marketing campaigns. I’ve highlighted these two opt-in methods below, and how best to ensure that your customers are affirming their consent to your brand’s SMS marketing terms and conditions.

Website Opt-Ins

For website opt-ins, affirming a customer’s consent to your brand’s SMS marketing terms and conditions is very straightforward. In the case of Dick’s Sporting Goods, this retailer didn’t do anything to make it clear to customers that by opting into their SMS marketing campaign, they were affirming their consent to the retailer’s SMS marketing terms and conditions. To make it clear to customers, I recommend clearly and conspicuously disclosing that your SMS marketing terms and conditions apply when opting in, then linking to the terms and conditions, like in the example below. Of course, you could also make customers check a box to confirm their consent to your SMS marketing terms and conditions to make it even more foolproof depending on your risk tolerance.

By participating, you consent to receive recurring autodialed SMS/MMS marketing msgs. No purchase required. Msg&data rates may apply. Terms & conditions/privacy policy apply www.brand.com/sms-terms.

I also recommend that you use a double opt-in for website opt-ins. This means that when a customer enters their mobile phone number into your website, they’ll receive an SMS message similar to the one below that they must reply “YES” to, in order to opt-in. By replying “YES” to the SMS message, the customer is again affirming their consent to your brand’s SMS marketing terms and conditions.

Brand Name: Reply YES for recurring autodialedSMS/MMS marketing msgs. No purchase rqd. Msg&data rates may apply. Terms apply www.brand.com/sms-terms

Why do I recommend for website opt-ins, that the customer affirm their consent to your brand’s SMS marketing terms and conditions, both on the website, and through SMS? One limitation with obtaining consent via a website is that the burden of proof to establish that the consumer provided consent to your brand’s SMS marketing terms and conditions lies with the message sender (you). This can cause problems for your business if a TCPA plaintiff claims that they were not aware of your SMS marketing terms and conditions, even though you think you clearly and conspicuously disclosed them to the customer before they opted-in.

Requiring customers to reply “YES” via SMS, to affirm their consent to your brand’s SMS marketing terms and conditions (again), provides a nice audit trail of the customers’ consent. Not only is this consent easy for an SMS provider to look up, as they simply have to search the customer’s messaging history, but it would also be extremely hard to argue that by replying “YES”, the customer wasn’t consenting to your brand’s SMS marketing terms and conditions.

Mobile Opt-Ins

A mobile opt-in is when someone opts into your SMS marketing campaign by text messaging an SMS keyword to an SMS short code. When advertising the call to action inviting consumers to opt-in, there should be no impediment to clearly and conspicuously disclosing that by texting in, the customer is agreeing to your SMS marketing terms and conditions. Like with the web opt-in, a similar type of disclosure on the call-to-action is needed.

By participating, you consent to receive recurring autodialed SMS/MMS marketing msgs. No purchase required. Msg&data rates may apply. Terms & conditions/privacy policy apply www.brand.com/sms-terms.

Under the federal E-Sign Act, an electronic signature “means an electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record.” Thus, the opt-in process of texting in an SMS keyword to an SMS short code itself can be used to establish that the individual is bound to your brand’s SMS marketing terms and conditions. In other words, the individual’s initial SMS message would act much like their signature on a written contract.

Like website opt-ins discussed above, the burden of proof to establish that the consumer affirmed their consent to your brand’s SMS marketing terms and conditions lies with the message sender (you). This can cause problems for your business if a TCPA plaintiff, opportunistically claims that they heard about your SMS campaign through word of mouth and were not aware of your SMS marketing terms and conditions before opting in.

This is why I also recommend a double opt-in for mobile opt-ins. This means that when a customer text messages your SMS keyword to your short code, they’ll receive an SMS message similar to the one below that they must reply “YES” to, in order to opt-in. By replying “YES” to the SMS message, the customer is again affirming their consent to your brand’s SMS marketing terms and conditions.

Brand Name: Reply YES for recurring autodialed SMS/MMS marketing msgs. No purchase rqd. Msg&data rates may apply. Terms apply www.brand.com/sms-terms

What’s the Takeaway?

If you’re an avid reader of the Tatango blog, you’re likely already aware of your TCPA SMS marketing compliance obligations, so what I’m hoping you take away from this post is the incredible value of having an arbitration and class-waiver provision in your SMS marketing terms and conditions. It’s very simple to incorporate into your existing SMS marketing terms and conditions, and doing so will allow you to make your SMS marketing campaign attractive only to your customers, instead of TCPA plaintiffs’ lawyers.