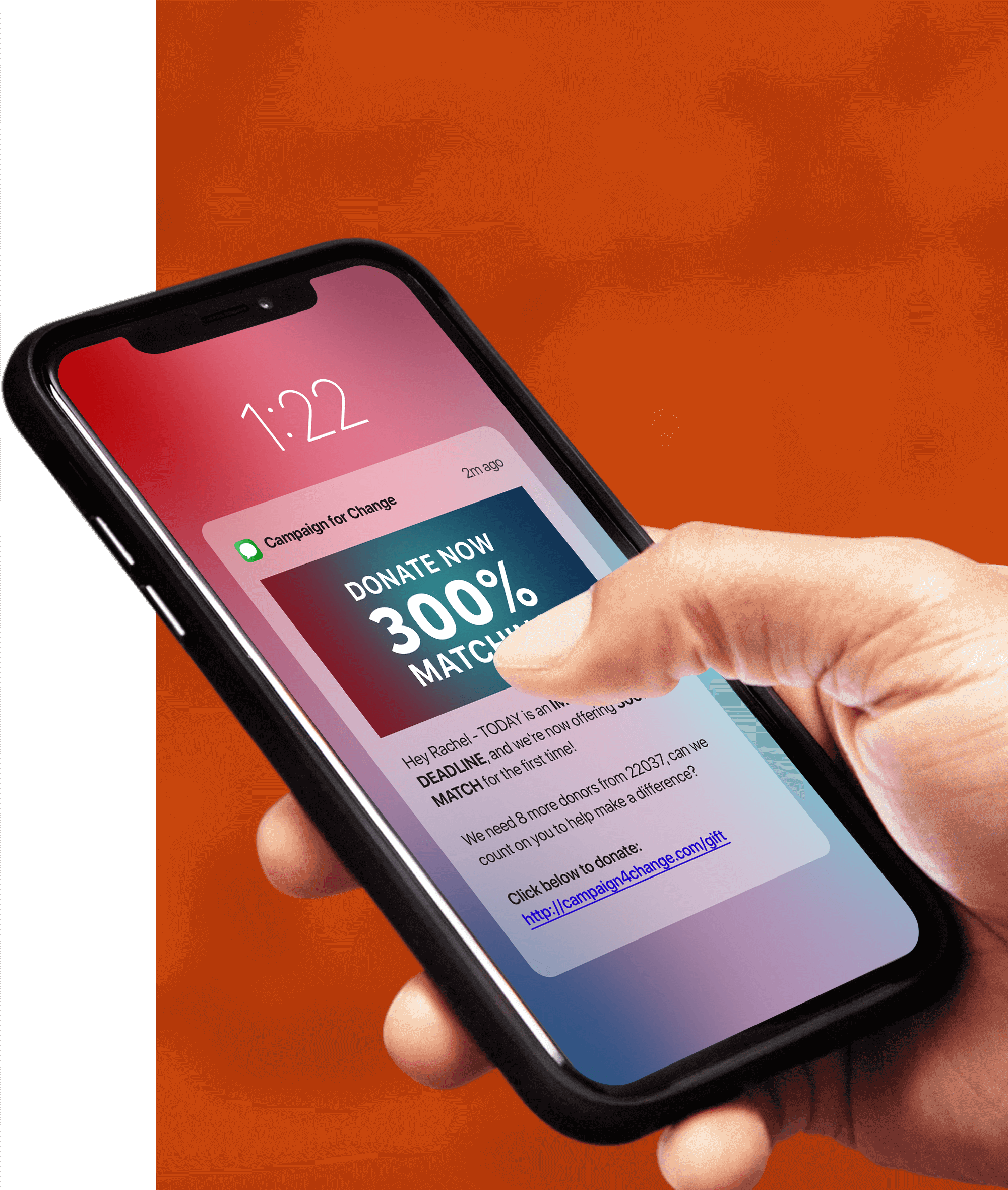

Tatango is a text messaging platform specifically built for fundraising.

We empower nonprofit organizations to send highly personalized and engaging text messages with a simple click. With unrivaled delivery speeds and 99% open rates, we help nonprofits reach their fundraising goals.

To learn more about Tatango, please select one the options below:

Nonprofit Text Messaging

Text to Give

SMS Short Codes

Nonprofit Texting Explained