3,422 Views

This video is brought to you by Innovista Law, home to the TCPA Defense Force. Innovista's lawyers have helped companies navigate potential TCPA landmines through effective risk-mitigation and compliance strategies.

To learn more about the TCPA and their services, visit www.tcpadefenseforce.com/tatango-partnership

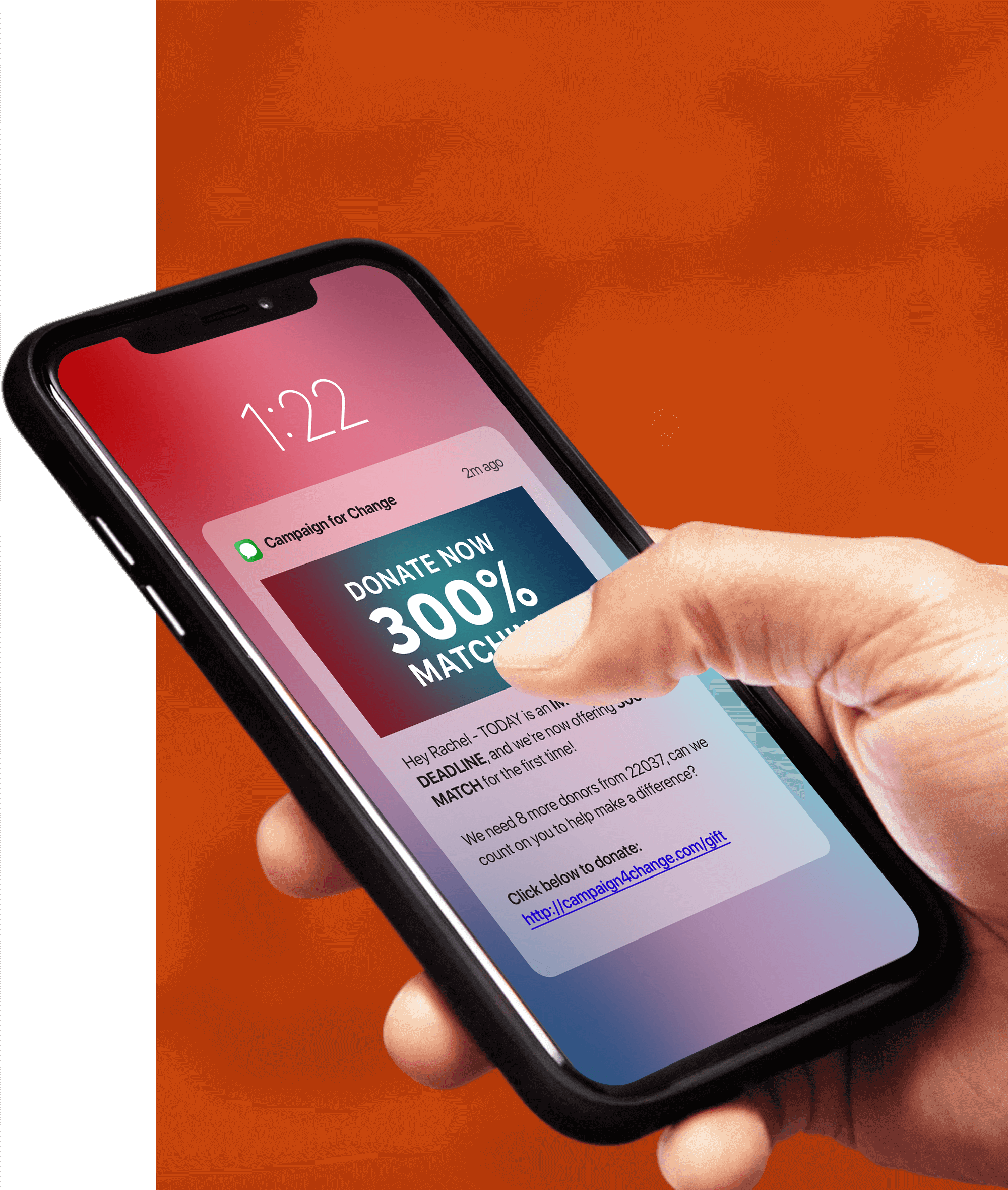

The majority of discussions and content around text message marketing, and the Telephone Consumer Protection Act (TCPA), revolves around brands trying to market a product or service to a consumer. While this is the first application of this technology that comes to mind, it leaves out an equally important set of organizations that benefit from text message marketing: nonprofit organizations.

Nonprofits and the TCPA

Nonprofit organizations operate under slightly different TCPA guidelines than standard brands. Any message sent by a nonprofit is subject to specific regulations.

Nonprofits and the Do Not Call Registry

To begin with, the FCC has exempted nonprofit organizations from needing to check the National Do Not Call Registry. Normally, an organization cannot message or call any number listed in that registry, but nonprofits don’t have to abide by those laws.

Additionally, nonprofits are not required to have an internal company Do Not Call list, whereas standard companies are. This is for two reasons: the nonprofit needs to be able to look for funding wherever possible, and spam-calling the same client over and over is not going to elicit sudden donations, so most nonprofits refrain from calling uninterested parties repeatedly as a form of best practice.

Nonprofits and Text Message Marketing

It’s important to note that while nonprofits may hire agents to help them with this kind of messaging, these exemptions only apply to messaging on behalf of the nonprofit. An agent cannot use their association with a nonprofit to justify sending out fraudulently exempted marketing messages for a brand. That would constitute a willful violation of the TCPA, and be punished with a $1,500 fine per message, per person.

There’s another important distinction between standard companies and nonprofits. Nonprofits have a lower threshold for acceptable consent than other organizations do. Put simply, nonprofit organizations do not require the same kind of consent. Where a brand would require prior express written consent in the initial greeting messaging, a nonprofit does not. Simply giving a nonprofit your phone number gives them justifiable consent to text or call you while remaining TCPA compliant.

What if a Nonprofit Is Selling Something?

Many nonprofits have merchandise or some form of non-donation revenue. Are they still exempt from the standard TCPA rules if their messaging is highlighting or focusing on these sale items?

The short answer is: no. Any messaging needs to be explicitly related to the nonprofit’s purpose to be exempt from the standard guidelines. If the nonprofit started selling a product or promoting a service, that messaging would be considered telemarketing. A nonprofit cannot promote a car, for example. If, however, the messaging is talking about merchandise that is explicitly connected to the nonprofit’s cause, then that would be acceptable for exemption.

However, that distinction can be blurry, and interpretations of this situation can vary greatly from court to court. Normally, if a nonprofit is highlighting something like a T-shirt carrying the nonprofit’s brand name, where the profits go directly into funding the nonprofit’s activities, then it would be alright for that messaging to follow nonprofit guidelines instead of company ones.

Understanding the TCPA for Nonprofits

We hope this breakdown was helpful to you! If you’re interested in learning more about text message marketing and the TCPA, check out our free TCPA Text Messaging Survival Guide.